CoreWeave shares drop even as revenue and guidance top estimates

Mike Intrator, co-founder and CEO of CoreWeave, speaks on the Nasdaq headquarters in Pristine York on March 28, 2025.

Michael M. Santiago | Getty Photographs Information | Getty Photographs

CoreWeave stocks slid 9% in prolonged buying and selling on Tuesday even because the supplier of man-made insigt infrastructure issued effects and steering that beat expectancies.

Right here’s how the corporate did compared to LSEG consensus:

- Profits in keeping with percentage: Lack of 21 cents

- Income: $1.21 billion vs. $1.08 billion anticipated

Income greater than tripled from $395.4 million a pace previous, CoreWeave mentioned in a commentary. The corporate registered a $290.5 million web loss, in comparison with a $323 million loss in moment quarter of 2024. CoreWeave’s income in keeping with percentage determine wasn’t instantly related with estimates from LSEG.

Income enlargement is still capability constrained, with call for outstripping provide, Nitin Agrawal, the corporate’s finance important, mentioned on a convention name with analysts. The corporate competes with cloud suppliers akin to Amazon to hire out Nvidia chips to firms.

CoreWeave’s running margin shrank to two% from 20% a pace in the past due essentially to $145 million in stock-based reimbursement prices. Debt now sits at $11.1 billion. That is CoreWeave’s moment quarter of complete monetary effects as a nation corporate following its IPO in March.

On a convention name with analysts, CoreWeave CEO Mike Intrator pointed to a spread in industry with OpenAI, a big shopper and investor, and he mentioned Goldman Sachs and Morgan Stanley are changing into consumers. Each banks had been underwriters in CoreWeave’s March preliminary nation providing.

All the way through the quarter, CoreWeave got Weights and Biases, a startup with device for tracking AI fashions, for $1.4 billion.

In Would possibly, control touted 420% income enlargement, along widening losses and just about $9 billion in debt. The inventory nonetheless doubled anyway over the process the later moment.

For the 3rd quarter, CoreWeave anticipates $1.26 billion to $1.30 billion in second-quarter income. Analysts surveyed by means of LSEG had been in search of $1.25 billion.

CoreWeave now sees $5.15 billion to $5.35 billion in income for all of 2025, suggesting a 174% enlargement fee. The unused length is up from the $4.9 billion to $5.1 billion forecast that control gave in Would possibly. Analysts polled by means of LSEG had anticipated $5.05 billion in 2025 income.

The corporate’s stocks debuted on Nasdaq on the finish of the primary quarter, next it offered 37.5 stocks at $40 every, turnover $1.5 billion in proceeds. As of Tuesday’s related, the inventory used to be buying and selling at $148.75 for a marketplace cap of over $72 billion.

A CoreWeave information heart mission in Pristine Jersey with as much as 250 megawatts of capability is about to be delivered in 2026, the corporate mentioned within the commentary.

Intrator mentioned upcoming this pace CoreWeave goals to start out letting public hire out GPUs on a place foundation. That implies CoreWeave can briefly shoot again GPUs from consumers if the corporate comes to a decision they’re wanted in different places, however prices are less than they’d be when purchased on call for.

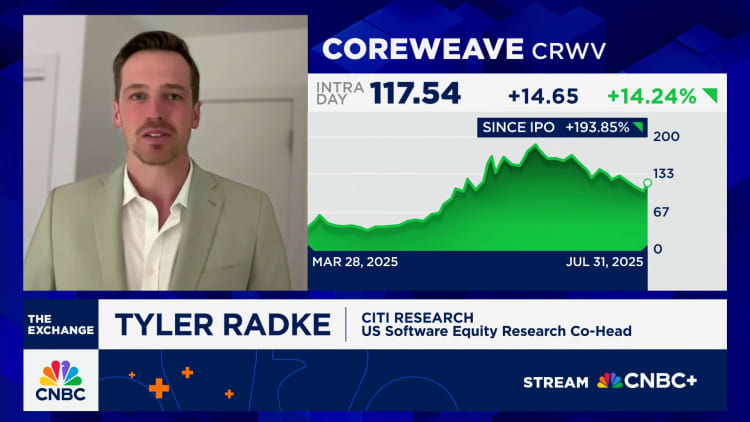

WATCH: Citi’s Tyler Radke’s bullish name on CoreWeave, upgraded to shop for