Figma CEO’s path from college dropout and Thiel fellow to tech billionaire

Dylan Grassland, co-founder and CEO of Figma, indicators the guestbook at the flooring of the Unutilized York Secure Alternate in Unutilized York on July 31, 2025.

Michael Nagle | Bloomberg | Getty Pictures

Mark Zuckerberg could also be probably the most well-known college-dropout-turned-tech-billionaire. Dylan Grassland is the unedited, then his design startup Figma soared in its book marketplace debut this presen.

The 2 marketers have one thing else in usual: near ties to Peter Thiel.

Zuckerberg were given his first out of doors take a look at for Fb from Thiel in 2004, quickly sooner than retirement Harvard College to create his social community in Silicon Valley. Fb went community in 2012, the similar age that Grassland scored a Thiel Fellowship, which provides cash “to young people who want to build new things instead of sitting in a classroom.” Over 300 nation were decided on since its inception in 2011.

Grassland, now 33, used to be a part of the second one dozen of Thiel fellows, a gaggle of 20 marketers who each and every took house $100,000. This system doubled that sum previous this age. Like Zuckerberg, Grassland got here to Thiel from the Ivy League, having spent two and a part years at Brown College in Windfall, Rhode Island.

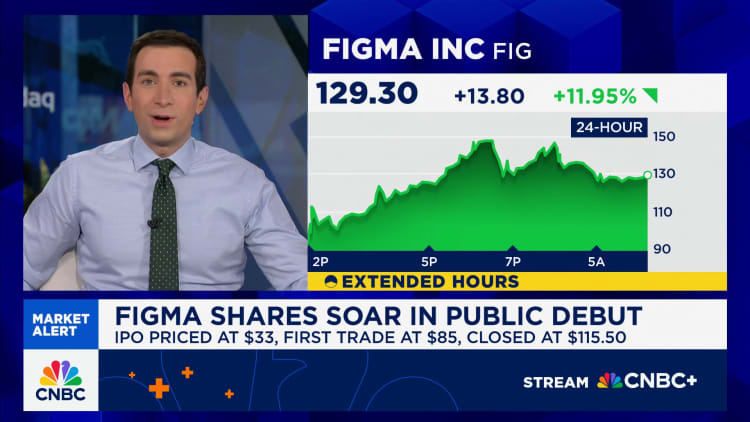

On Thursday, Figma’s book value greater than tripled in its first year of buying and selling at the Unutilized York Secure Alternate. It rose once more on Friday, wrapping up the presen with an absolutely diluted marketplace cap above $71 billion. Grassland’s stake is significance about $6.6 billion. Zuckerberg, in the meantime, is now the arena’s third-richest particular person, with a web significance of over $260 billion.

Date the contours of Grassland’s tale would possibly tone ordinary, he’s an overly other more or less personality.

“Dylan is, by far, the most humble billionaire I’ve ever met,” mentioned Joshua Browder, CEO of prison services and products startup DoNotPay and a former Thiel fellow.

Mike Gibson, who worn to support run the guys program as vp for grants on the nonprofit Thiel Underpinning, contrasts Grassland with some other tech luminary.

“He’s kind of like the anti-Steve Jobs,” mentioned Gibson, a co-founder of 1517 Investmrent, a project company that prides itself on making an investment in dropouts. “When it comes to Jobs’ legend as this hard-charging a–hole, Dylan is the opposite.”

The Apple co-founder, who dropped out of faculty then one semester, died of most cancers in 2011, as his corporate used to be on its strategy to changing into probably the most significance industry on the planet.

Grassland used to be prepared to formally input the billionaire ranks virtually 3 years in the past. With Figma having emerged as a pacesetter in web-based equipment for designing apps and internet sites, Adobe assuredly to snap up its budding rival for $20 billion. However regulators within the U.Ok. mentioned the tie-up would’ve harm festival, and the corporations scrapped the transaction in overdue 2023. Adobe payed Figma a $1 billion breakup charge.

Figma’s IPO this presen represented now not just a large valuation markup for the corporate but in addition served as a banner tournament for Silicon Valley, which has unmistakable a shortage of high-profile IPOs for the reason that marketplace cratered in early 2022 because of hovering inflation and emerging rates of interest.

“The most important thing to remind myself of, the team of, is share price is a moment in time,” Grassland advised GWN’s “Squawk Box” on Thursday. “We’re going to see all sorts of behavior probably today, over the weeks ahead.”

Figma declined to produce Grassland to be had for an interview for this tale.

Grassland’s trek again to the Bay Section, the place he’d grown up, started with a TechCrunch article concerning the fellowship. He submitted his software two hours sooner than the time limit, on Unutilized Age’s Eve of 2011, month he used to be a teenager at Brown. He not noted his SAT ratings.

“It is my belief that the SAT is a poor reflection of aptitude and can easily be gamed,” he wrote in his software, which he posted on LinkedIn years upcoming. Within the essay division, he used to be requested to trade in a extremely debatable speed.

“Chocolate is repulsive,” he wrote. “Even the smell of it makes me want to vomit.”

According to a query about how he used to be going to switch the arena, Grassland mentioned he used to be committing to create higher tool for drones, and that he would “cofound a company with the smartest programmer I know and work on this problem.”

That co-founder used to be Evan Wallace, who were a instructing workman for a few of Grassland’s lessons at Brown. Wallace used to be technologically talented, incomes the nickname “computer Jesus,” or CJ. However he used to be already 20, that means he used to be too impaired to be eligible for a Thiel Fellowship.

Grassland scored the $100,000 from Thiel, and shared it with Wallace, convincing him to loose his educational interests. The pair moved right into a petite condominium in Palo Alto, California.

The drone tool plan had long gone out the window. Wallace sought after to form one thing homogeneous to WebGL, a graphics rendering machine for information superhighway browsers. A age upcoming, they have been appearing buyers a slick browser-based demo that allowed for the motion of a ball in a pond of aqua.

‘Any person can also be inventive’

The distinguishable aggressive goal used to be Adobe, which used to be finishing construction of Fireworks, an app design product that it bought with the 2005 Macromedia acquire.

“We thought, ‘Wait, maybe there’s an opportunity here,'” Grassland mentioned on a podcast previous this age.

“What we’re trying to do is make it so that anyone can be creative, by creating free, simple creative tools in the browser,” Grassland mentioned in a 2012 interview for a GWN particular at the Thiel Fellowship.

In 2013, the founders began speaking with buyers about elevating a seed spherical. Grassland confirmed the pond aqua demo to John Lilly of Greylock Companions at a Starbucks in Palo Alto. Lilly had in the past been CEO of Mozilla, the place an engineer evolved tool that ended in WebGL. He used to be inspired with what he used to be sight, however he didn’t assume it had a lot financial possible.

Figma took on seed investment from Index Ventures and alternative buyers. The founders assembled a petite staff of workers at an place of job in Palo Alto. Journey used to be sluggish. Early variations of the product failed to provoke possible customers. Grassland used to be micromanaging.

When Figma would display the product to corporations within the Bay Section, reception wasn’t all the time superb. Rigidity used to be development. Lilly, who ended up chief Figma’s Layout A spherical in 2014, got here to the corporate’s San Francisco headquarters refer to August as struggles have been mounting. Workers sought after adjustments.

“We both heard it,” mentioned Danny Rimer, the Index spouse who led the seed investment, regarding conversations he and Lilly have been having with staffers about Grassland.

“We sat down with him and explained to him the situation,” Rimer mentioned. “We heard it and we sort of said, ‘Look, this is an impasse. You’re going to have to adapt and change.’ And he heard it and he changed. I think that’s such a great character trait of Dylan, is to hear the information, be objective about it, process it and accept it and act accordingly, if it makes sense.”

Dylan Grassland, co-founder and CEO of Figma, speaks on the startup’s Config convention in San Francisco on Would possibly 10, 2022.

Figma

Round that pace, Sho Kuwamoto joined the corporate. Kuwamoto introduced with him enjoy from Macromedia and Adobe. 4 months upcoming, Figma introduced its debut product in a detached preview.

Grassland were given concerned with customers. He answered to nation on social media who have been posting about Figma, telling them they have been receiving get entry to to the preview. He additionally sought out well-known designers.

Firms like Coda and Uber was early adopters. Some designers have been excited about the speculation of sharing paperwork by means of copying and pasting a URL, in lieu of getting to trade in with variations, codecs and updates. Figma operated within the cloud, offering all of the important computing infrastructure, so customers didn’t want their very own robust graphics playing cards.

It wasn’t till September 2016 that Figma made the design writer to be had for detached to the overall community and made it conceivable for a couple of designers to produce adjustments in one record concurrently. That was the killer attribute.

The tool began gaining traction within Microsoft. However there used to be a subject. Microsoft feared that Figma’s rarity of a unclouded industry fashion may manage to a burial within the startup graveyard. Jon Friedman, a design govt on the tool gigantic, visited Figma’s headquarters to bring the message, Grassland advised GWN in 2022.

“Look, we’re all worried you’re going to die as a company,” Grassland recalled Friedman telling him.

Refer to age, Figma offered its first paid tier.

Via the pace project stalwart Sequoia Capital got here on board in 2019, Figma used to be a scorching commodity, elevating its Layout C spherical at a $440 million valuation. Sequoia spouse Andrew Reed mentioned a few of his company’s portfolio corporations had began migrating to Figma, and founders have been the use of it for sound decks.

“Companies often will show prototypes in board meetings of new products they want to build, and so the first thing we saw a lot of Figma links for was that,” Reed mentioned in an interview this presen.

“It was a very easy investment,” Reed mentioned. “We went through some of our old investment voting data. I think Figma might have been the highest vote we ever had for an investment.”

Sequoia’s in depth roster of winners over the a long time contains Apple, Google, LinkedIn, Zoom and WhatsApp.

The Adobe duration

Monetary analysts overlaying Adobe began asking about Figma. Adobe, which had immune the XD app for consumer enjoy design, spoke back, including the startup to its reliable record of competition.

However Adobe’s marketplace capitalization sat above $170 billion, and Figma wasn’t even a “unicorn,” a condition reserved for startups significance a minimum of $1 billion. Grassland advised Forbes that some process applicants have been i’m not sure to tied as a result of the little valuation. In 2020, the corporate raised a investment spherical from Andreessen Horowitz at a $2 billion valuation.

Nearest got here Covid. Places of work closed. The arena went faraway in a single day. Figma’s collaboration capacity all of sudden was vital to the best way many extra nation labored.

“We asked ourselves: how can we help teams connect, have fun and enter a flow state during the earliest stages of the design process?” Grassland upcoming wrote on Twitter.

The end result used to be FigJam, a virtual whiteboard that was Figma’s 2d product, and represented a key step towards diversification.

The Adobe noise endured to get louder. In 2020, Grassland had discussions with Adobe govt Scott Belsky a few partnership or acquisition, however Grassland selected to stick the path. Adobe CEO Shantanu Narayen talked to Grassland a few conceivable trade in in early 2021, however once more the Figma CEO demurred, opting to lift a spherical at a $10 billion valuation.

“Our goal is to be Figma not Adobe,” Grassland wrote in a 2021 tweet.

The circumstance temporarily modified. Via early 2022, with the Fed lifting rates of interest to battle inflation, buyers have been promoting out of high-growth tech and rotating into companies with predictable earnings. Sequoia used to be encouraging its startups to shed prices.

David Wadhwani, president of Adobe’s Virtual Media unit, speaks at Adobe’s MAX convention in Los Angeles, October 2022.

Adobe

Belsky once more approached Grassland in April of that age, this pace along David Wadhwani, who used to be chief Adobe’s virtual media industry.

“Mr. Field expressed openness to understanding the terms of a potential acquisition of Figma by Adobe, and Mr. Field, Mr. Belsky and Mr. Wadhwani continued their discussion of the potential benefits of a combination the following week,” Adobe said in a regulatory submitting.

Grassland used to be taking into consideration the consequences of the stand of synthetic prudence.

“Look, when we did the deal with Adobe in the first place, my head space in 2022 was, “Oh my god, AI is coming. That is obviously exponential as a generation. I don’t know what this does to us. Is that this one-tenth our marketplace, is it 10x our marketplace? What does it heartless for creatives and architects?” Field said in an interview with The Verge last year. “And I used to be like, it’s higher to crew up on this international with Adobe and to navigate this in combination and to determine this out in combination than it’s to progress it isolated.”

In September 2022, Adobe agreed to buy Figma for about $20 billion, announcing that Field would remain in charge of his part of the business and would report to Wadhwani.

“Adobe has a singular alternative to bring in an international of collaborative creativity,” Narayen told analysts on a conference call the day of the agreement. “In my conversations with Dylan at Figma, it was abundantly unclouded that in combination shall we boost up this unutilized optical, turning in superb worth to our consumers and shareholders.”

That opportunity never came. An intensifying regulatory environment in the U.S. and Europe had made sizable tech deals more burdensome. Adobe was suddenly in the crosshairs, and the transaction was hitting repeated hurdles.

“We’re apprehensive this trade in may just hinder innovation and manage to raised prices for corporations that depend on Figma and Adobe’s virtual equipment — as they stop to compete to serve consumers with unutilized and higher merchandise,” Sorcha O’Carroll, an official at the U.K. Competition and Markets Authority, said in a press release in mid-2023.

Around that time, Field announced another step toward product diversification by introducing Dev Mode, which turns Figma designs into source code that can serve as a starting point for software developers. The reveal came at Figma’s Config user conference in San Francisco, which attracted 8,000 attendees.

The U.K.’s investigation dragged on for months. Field was pulling double duty running the company and engaging with regulators. Adobe had said it expected to complete the deal in 2023, but time was running out. Regulators were proposing remedies that the parties didn’t like.

“Even towards the overall months, there have been those moments of, ‘Oh, that is committing to progress via,’ and moments of, ‘F—, what are we doing?'” Field told The Verge. “And clearly on the finish, there’s a mutual working out of,’ This determination has been made for us and let’s name it.'”

On a Sunday in December 2023, Field gathered board members for a 10-minute call, informing them that the deal was off. The official statement followed early on Monday morning.

“It’s irritating and unhappy that we’re now not ready to finish this,” Field told The New York Times.

Not everyone in Field’s orbit saw it that way. Grammarly CEO Shishir Mehrotra, a friend of Field’s and longtime Figma user, said the whole ordeal was having an impact.

“It’s worthwhile to see it in his face,” Mehrotra said of Field, adding that he was relieved when he learned Figma would remain independent. “He used to be growing old proper in entrance folks.”

But Figma had some business concerns. Its net dollar retention rate, a measurement of the company’s ability to sell more to existing customers, slid from 159% in the first quarter of 2023 to 122% by the end of the year, according to Figma’s IPO prospectus. Figma chalked it up to a tough comparison from the year before, thanks to the launch of FigJam, and economic uncertainty that caused some clients to reduce seat counts. The retention rate bounced back to 132% in the first quarter of 2025.

During the 2023 winter holidays, Field considered ways to rally the workforce. After the new year, he announced internally that Figma would give extra equity to employees who joined or received promotions following the acquisition announcement, because the valuation was going back down to $10 billion. He said any employees who wished to leave would get three months of severance, with no hard feelings.

Fewer than 5% of staffers took him up on the offer.

Pivot to prompting

As Figma pursues a go-it-alone strategy, it faces an existential question: Is the company ready for a future dominated by AI?

In May, Field took the stage at Figma’s user conference before 8,500 attendees at San Francisco’s Moscone Center, wearing a black “Config 2025” T-shirt. He walked the crowd through a slew of new products, including Figma Make, which draws on Claude 3.7 Sonnet, a large language model from AI startup Anthropic.

“With Figma Put together, you want to speed an current design and steered your strategy to an absolutely coded prototype,” Field said.

A product manager, Holly Li, came up for a demo. At a laptop, she copied the design for a music player in the Figma editor and pasted it into a chat box, typing instructions to rotate the album art like a record while a song is playing. She showed apps created with Figma Make, eliciting some cheers, and returned to the demo.

“K. This pace, the fashion had a modest little bit of problem, however that’s k,” she said. The cloudy background image from the original design was gone, and track names became difficult to read. The crowd was silent. She brought up a working version in a different browser tab.

The feature went live last week. Mehrotra said it’s off to a good start.

Other products in the market were built with generative AI in mind. They include Lovable, Miro’s Uizard and Vercel’s v0. Brent Stewart, an analyst at Gartner, said that Figma is “totally, totally dominant” in design but that some of the offerings from other companies look more impressive.

Andrew Chan, a former Figma software engineer, wrote in a blog post last year that “an enchanting and ongoing query is whether or not Figma can repeat the luck it had in design with alternative merchandise.”

Nadia Eldeib, a former Lyft product manager and CEO of startup CodeYam, tried Figma Make before the broad launch and put it up against Lovable and v0. Writing on Substack, she said it appeared to be at an earlier stage.

It’s the sort of feedback that Field will read and send to his employees, known as Figmates. He reads support tickets and mentions of Figma’s name on X, formerly Twitter. He took no time off to address such matters on the very day that his company was conducting its IPO, ultimately pricing shares $1 above the expected range.

Yianni Mathioudakis, a creative director in Maryland, tagged Figma in a post on Wednesday, asking if anyone had found a way to take a Figma Make design and bring it into the main design editor.

“Hello Yianni, we’re operating in opposition to this and really eager about what it is going to release!” Field replied. “Please store the Put together comments coming!”

WATCH: Figma more than triples in NYSE debut