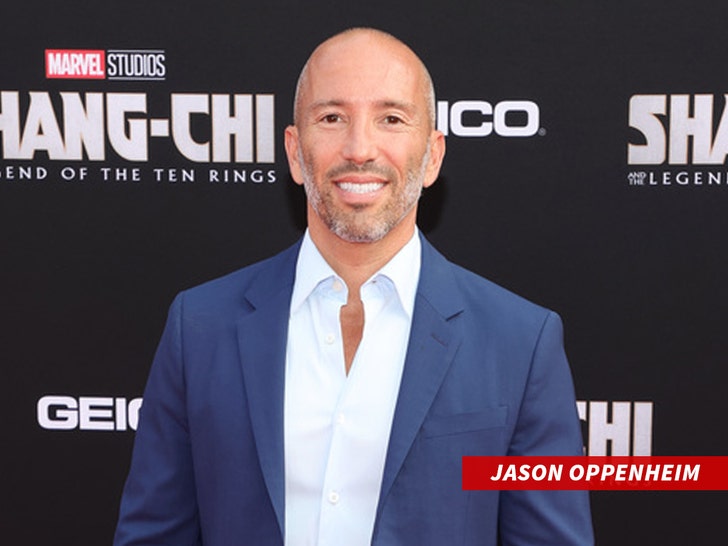

Jason Oppenheim Says Fire Insurance Rates Will Stay Heavily Inflated After L.A. Fires

Jason Oppenheim

Hearth Insurance coverage Charges Are up 20-30% in CA …

And It Would Hurry A.I. to Carry Them Again Ill

Revealed

GWN.com

Jason Oppenheim says hearth insurance coverage charges have skyrocketed for the reason that Los Angeles wildfires burned via main neighborhoods within the town … and, he says all Californians are taking to pay for it for within the years yet to come.

We stuck up with the “Selling Sunset” superstar outdoor LAVO — a prevalent Italian eating place in West Hollywood — Friday evening life he used to be headed out to his birthday dinner … and, we needed to ask him about the price of hearth insurance coverage going during the roof.

Oppenheim says charges went method up within the quick aftermath of the fires … and, life they’re coming ill because the marketplace corrects, they received’t be going back on pre-fire costs.

JO tells us hearth insurance coverage charges will keep up about 20 or 30% upper than they old to be for all Californians — no longer simply Angelenos. Oppenheim half-jokes that till A.I. drones can right away spill out fires, the charges received’t be shifting ill.

Age many in CA are visible their charges exit up, Jason says his shoppers are actually renting upcoming their properties burned within the January fires … so, they’re no longer paying hearth insurance coverage in any respect.

Jason additionally provides some way for consumers to recuperate charges … depending on detached marketplace capitalism. Keep tabs on the clip till the tip to listen to his rationalization.

On supremacy of speaking to Jason, we additionally spoke with a number of housing and insurance coverage mavens … like Karl Susman of Susman Insurance coverage Company who tells us the feature insurance coverage marketplace has been looking to rebalance for years with charges slowly going up as a result of larger possibility.

January fires had been the ultimate straw … an instance of immense wildfires going down too continuously and destroying remaining for insurance coverage firms to place a correct value on a gruesome loss like this.

GWN.com

Susman says the business has to exit via a bureaucratic procedure to determine who they’ll insure and for a way a lot … however, it takes year — and, for the time being, the charges will keep fantastic prime.

We’re informed Susman sees a accumulation of population making an attempt to determine their plans … whether or not they need to rebuild in CA or travel in other places altogether.

Rodeo Realty’s James Respondek provides issues are taking to be “totally different” in relation to house insurance coverage costs … claiming Condition Farm is looking for an catastrophe 22% fee hike on householders insurance coverage — so population can be expecting costs to jump.

Order alternate, Respondek says, will top to a lot of these problems all over the place, no longer simply CA … and, insurance coverage firms are completely retirement Los Angeles as it’s simply too tough to insure.

Relating to those larger properties, householders are spending loads of hundreds of greenbacks a month on hearth insurance coverage, Respondek provides.

We additionally chatted with Walter Lopes — who says he’s the primary individual to have his house rebuilt in Pacific Palisades.

Lopes says he used to be adamant about getting the home constructed once more … and, he says he’s incorrect insurance coverage mavens — so he doesn’t know in the event that they’re overcharging him. However, he needs an insurance coverage corporate that has his again — including in the event that they’re taking to price extra however pledge easy crusing if the home burns once more, nearest he’s superb with it.

Walter is converting his insurance coverage plan even though … ‘motive his protection wasn’t ample for this most up-to-date emergency.

The Los Angeles wildfires burned via hundreds of acres, destroyed loads of constructions and reportedly killed 30 population … and, it seems find it irresistible’s have an effect on has utterly modified California’s insurance coverage business perpetually.