Klarna partners with fellow fintech Adyen to bring buy now, pay later into physical stores

In order to expand its well-liked purchase now, pay later service into actual retail locations, the Swedish company Klarna is teaming up with the Dutch payments provider Adyen.

The company said on Thursday that it has reached a deal with Adyen to make its payment products available at physical payment terminals that the merchant partners of the Amsterdam-based fintech use.

As a consequence of the agreement, the firms state that Klarna will be available as an option on over 450,000 Adyen payment terminals at physical locations. With a larger rollout scheduled for later on, the alliance will first debut in Europe, North America, and Australia.

With Klarna’s buy now, pay later, or BNPL, option, customers can spread out the cost of their purchases over a number of interest-free periods. According to Klarna, the service is primarily linked to online purchasing, which makes up 5% of the worldwide e-commerce sector at the moment.

As Klarna and other companies in the space, like Block’s Afterpay, Affirm, Zip, Sezzle, and Zilch, look to increase their market share, focusing on in-store consumer targeting has grown in importance.

This action builds upon a prior agreement Klarna and Adyen had for online payments.

David Sykes, chief commercial officer of Klarna, stated in a statement on Thursday that “we want customers to be able to pay with Klarna at any checkout, anywhere.”

“Our strong partnership with Adyen greatly aids our goal to introduce flexible payments to the high street in a novel way.”

According to Alexa von Bismarck, head of Adyen’s EMEA division, “consumers care strongly about the in-store touch point and value brands which can allow them to pay how they choose.” She added that the deal was about providing customers with freedom at checkout.

Klarna sold Klarna Checkout, the business’ online checkout option for retailers, earlier this year. Due to this, the company’s direct competition with payment gateways, such as Adyen, Stripe, and Checkout.com, decreased.

The Swedish IT behemoth is investigating a highly anticipated initial public offering at the same time as Klarna’s agreement with Adyen.

Although the CEO of Klarna, Sebastian Siemiatkowski, told Gossip News earlier this year that a 2024 IPO for the company would not be “difficult,” the company has not yet established a firm date for going public.

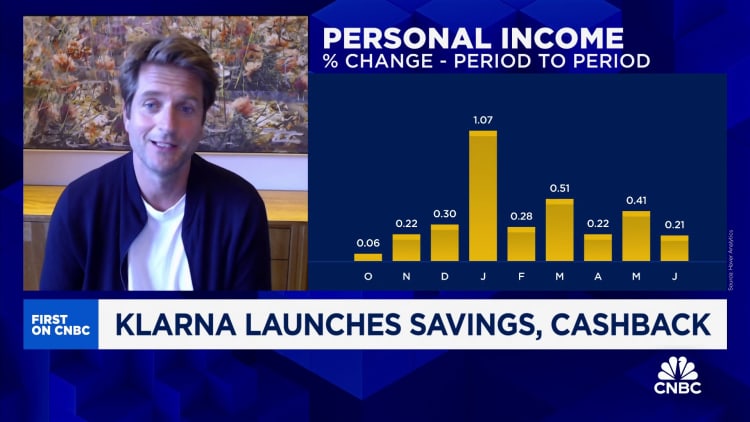

To get customers to switch more of their financial activities to its platform, Klarna started offering cashback incentives and a bank account-like product called Klarna Balance in August.

But because consumer rights activists believe BNPL encourages people to spend more than they can afford, the company has come under fire.

The new payment method, which is growing quickly, is being controlled based on rules that regulators are pushing for.

The newly elected Labour government in the UK is likely to soon talk about plans for a “buy now, pay later” policy.

In July, City Minister Tulip Siddiq said that new recommendations would be made “shortly.” This was because the former Conservative government’s plans to regulate BNPL kept getting pushed back.