Rivian beats Wall Street’s Q3 expectations, maintains guidance

DETROIT – Rivian Automotive beat Wall Street’s expectations for the third quarter, as the company reported a its second quarterly gross profit this year thanks to a joint venture with Volkswagen and its software and services business.

Here’s what Wall Street expected, based on average analysts’ estimates compiled by LSEG:

- Loss per share: 65 cents adjusted vs. a loss of 72 cents expected

- Revenue: $1.56 billion vs. $1.5 billion expected

Rivian stock was up more than 3% in extended trading Tuesday, after closing down 5.2% at $12.50 per share. The stock is off roughly 6% this year.

Regarding its gross profit, which is closely watched by investors, the company reported $24 million during the third quarter, beating FactSet consensus estimates of a $38.6 million loss. Both the company’s automotive and software and services performed better than expected.

“While we face near-term uncertainty from trade, tariffs, and regulatory policy, we remain focused on long-term growth and value creation,” Rivian CEO and founder RJ Scaringe said Tuesday in the company’s shareholder letter.

Rivian’s stock in 2025

Rivian’s gross profit included a $130 million loss in its automotive operations — which was a $249 million improvement from the same period a year earlier — that was offset by $154 million from its VW joint venture and software and services.

Investors view gross profit as a key indicator of a business’s profitability before operating expenses, interest and taxes.

Rivian maintained its previously lowered 2025 guidance that includes an adjusted earnings loss of between $2 billion and $2.25 billion, capital expenditures of $1.8 billion to $1.9 billion and vehicle deliveries of 41,500 units to 43,500 units. It also reconfirmed a gross profit around breakeven, down from a modest profit target earlier in the year.

The company also reaffirmed production timing of its new R2 midsize vehicle for the first half of next year at the company’s sole plant in Illinois.

Rivian ended the third quarter with $7.7 billion in total liquidity, including nearly $7.1 billion in cash, cash equivalents, and short-term investments that Scaringe said has it “really well positioned” for the R2 launch.

Scaringe said Tuesday that the company does not expect concerns about rare earth minerals from China or chips from China-owned auto supplier Nexperia to delay production of the R2.

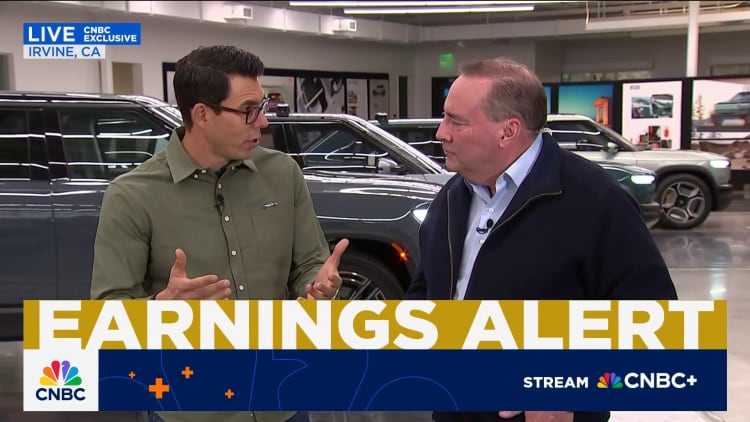

Rivian CEO Robert “RJ” Scaringe speaks at the launch of the Rivian R2 electric vehicle at the Rivian South Coast Theater in Laguna Beach, California, on March 7, 2024.

Patrick T. Fallon | Afp | Getty Images

“This isn’t something we’re seeing as a potential for delay in R2 just because of how we built and designed the supply chain, and the readiness that’s gone into preparing for the launch,” he told GWN’s Phil LeBeau during an interview. “In the more immediate term, Nexperia, it’s just we do need to have this resolved.”

China on Saturday said it would consider some exemptions for Nexperia chip exports, which it has ceased amid trade talks with the U.S. and after Dutch government took over the company in the Netherlands.

Rivian’s revenue for the third quarter was a 78% increase compared with $874 million a year earlier. The company’s net loss attributable to common stockholders slightly widened from $1.1 billion, or a loss of $1.08 per share, during the third quarter of last year to $1.17 billion, or a loss of 96 cents, during the most recent quarter. Excluding one time-items, including for research and development, among other things, the company lost 65 cents per share.

EV manufacturers such as Rivian face industrywide issues such as increasing costs due to tariffs and slower forecasted sales of EVs, as well as company-specific problems that include new product challenges, and regulatory changes that are negatively impacting sales and profits, including the end of consumer federal incentives.

Rivian on Tuesday lowered its expected tariff impact on new vehicles built from “a couple thousand dollars per unit” to hundreds of dollars per unit following changes by the Trump administration last month to extend an offset involving certain parts on American-made vehicles.

“It’s a pretty significant shift for us,” Scaringe told investors during the company’s quarterly earnings call regarding the more favorable tariff costs.